What Is an IPO? The Ultimate Guide to Initial Public Offering in 2025

Have you ever seen a company make headlines saying it's “going public” and thought, “Should I invest? Is this a jackpot moment or just hype?” That’s the IPO buzz! In this blog, we’re diving deep into Initial Public Offerings (IPOs) — what they are, why they matter, and how to navigate the excitement wisely. Whether you’re from India, the USA, or just a curious global citizen, this guide is your go-to playbook.

Nagarjun

5/21/20254 min read

What Is an IPO? The Ultimate Guide to Initial Public Offering in 2025

Have you ever seen a company make headlines saying it's “going public” and thought, “Should I invest? Is this a jackpot moment or just hype?” That’s the IPO buzz! In this blog, we’re diving deep into Initial Public Offerings (IPOs) — what they are, why they matter, and how to navigate the excitement wisely. Whether you’re from India, the USA, or just a curious global citizen, this guide is your go-to playbook.

✅ What Is an IPO?

An IPO (Initial Public Offering) is when a private company sells its shares to the public for the first time on a stock exchange. Think of it like this — the company is hosting a “grand opening sale” where it offers slices of ownership (aka shares) to everyday investors like you and me.

It’s a major milestone, often signaling growth, ambition, and public trust. The shares are typically listed on exchanges like:

NSE/BSE in India

NASDAQ/NYSE in the USA

💼 Why Do Companies Go for an IPO?

Companies launch IPOs for a variety of smart reasons:

To raise capital — for expansion, paying debts, research, or entering new markets.

To increase brand credibility — a public company commands more trust.

To allow early investors and founders to cash out.

To attract better talent — stock options become a recruitment perk.

Going public isn't just about money; it’s also about transparency and scaling up operations like never before.

📈 How Does an IPO Work?

Here’s a simplified breakdown:

Appointment of an investment bank – They underwrite and guide the IPO process.

Filing of the DRHP (Draft Red Herring Prospectus) – This document has all the company info you need (like revenue, risks, future plans).

Price band announcement – A price range is decided for each share.

IPO opens for bidding – Usually open for 3–5 days.

Allotment – Based on demand and bidding, shares are allotted.

Listing Day – The company’s shares officially start trading on the stock exchange.

💡 Types of IPO Investors

When applying for an IPO, know which category you fall into:

Retail Individual Investors (RII) – The everyday folks. Max investment in India is ₹2 lakh.

High Net-Worth Individuals (HNIs/NII) – For bigger ticket investors.

Qualified Institutional Buyers (QIBs) – Mutual funds, banks, etc.

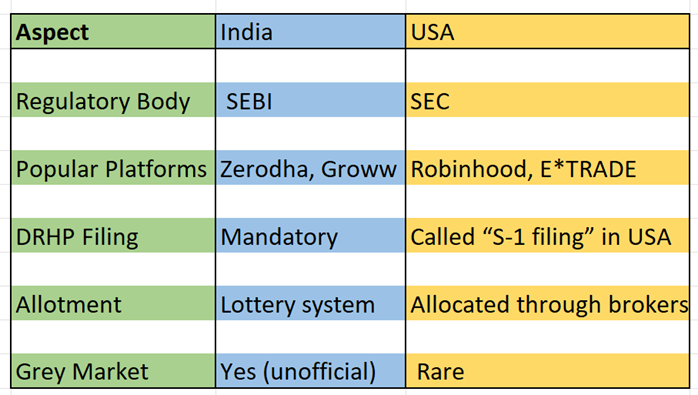

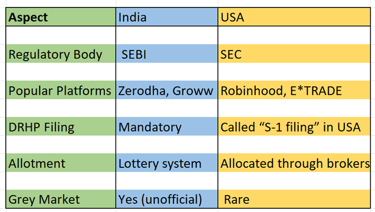

In the USA, retail investors often get access through brokers like Robinhood, Fidelity, or Charles Schwab.

🔥 What Makes an IPO Attractive?

You’ve probably heard success stories where people made 100%+ returns on Day 1. Here's what draws investors to IPOs:

First-mover advantage: Get in at ground level.

Listing gains: Quick profits if demand is high.

Long-term growth: Invest early in future giants like the next TCS, Zomato, or Tesla, NVIDIA.

But remember, not all IPOs are golden tickets. Some flop. So, how do you pick a winner?

🧠 How to Evaluate an IPO Before Investing

Here's your IPO checklist:

Factor What to Look For

📊 Financials Revenue growth, profit margins, debt

🏢 Business Model Is it scalable, unique, and future-ready?

👥 Management Team Experience, ethics, reputation

📄 DRHP Risk factors, plans, promoters’ stake

🤝 Anchor Investors Institutional backing = trust signal

Also, compare the valuation. Is it too hyped compared to existing listed peers?

⚠️ Risks Involved in IPO Investment

Let’s not sugarcoat it. IPOs are exciting but risky.

The hype can lead to overvaluation.

Lack of prior public data makes it tough to gauge performance.

Not all IPOs give listing gains — many dip post-launch.

Retail allotment is limited — you may not get shares despite applying.

So, go in with balanced expectations, not blind excitement.

IPO Scene in India vs. 🇺🇸 USA

Both markets have recently seen surges in IPO activity, especially from tech, fintech, and clean energy sectors.

🧩 Should You Invest in IPOs?

It depends on your goals:

Short-term trader? You might chase listing gains.

Long-term investor? Look for fundamentals and future scalability.

Beginner? Start small. Don’t bet your entire savings.

Also, diversify — IPOs should be one part of your portfolio, not the whole basket.

📣 Final Thoughts: IPOs Are Exciting, But Not Magic

The IPO world is thrilling — like the red carpet for companies. But remember, every glittering company isn't gold. Be informed, not influenced. Take time to read, reflect, and research.

When approached smartly, IPOs can absolutely be a stepping stone to wealth creation. But if you're just following trends without understanding the game, you’re gambling, not investing.

❓ Top 10 IPO FAQs Answered (India & USA)

1. What is the minimum amount needed to invest in an IPO?

➡️ In India, usually around ₹14,000–₹15,000 per lot. In the USA, it can vary, typically $100–$250 per share depending on the broker.

2. How are IPO shares allotted in India?

➡️ Through a lottery system for retail investors. If oversubscribed, you may not get any shares.

3. Can NRIs apply for IPOs in India?

➡️ Yes, via NRE/NRO accounts with ASBA facility.

4. What is a grey market premium (GMP)?

➡️ It’s the unofficial premium investors are willing to pay before listing. It gives a hint about listing expectations.

5. Can I sell IPO shares on listing day?

➡️ Absolutely. If shares are allotted, you can sell them as soon as trading begins.

6. Is it safe to invest in every IPO?

➡️ No. Always analyze the company’s fundamentals and prospects before investing.

7. What’s the difference between a fixed price and book-built IPO?

➡️ Fixed-price has a set share price. Book-built offers a price band; final price is based on demand.

8. Can I apply for IPO through UPI in India?

➡️ Yes! Most platforms now offer seamless UPI-based applications.

9. Are IPO gains taxable?

➡️ Yes. In India, gains are subject to short-term or long-term capital gains tax. In the USA, capital gains tax applies as per IRS rules.

10. Where can I track upcoming IPOs?

➡️ In India: NSE/BSE websites, Moneycontrol, Chittorgarh

➡️ In USA: Nasdaq IPO calendar, Yahoo Finance

Stay Ahead, Stay Informed 🚀

IPOs are like new doors to opportunity. But just like any adventure, preparation is key.

Bookmark this blog, share it with your friends, and don’t forget to visit us regularly for more such rich, actionable, and jargon-free articles. Whether you're in Mumbai or Manhattan, we’ve got your financial learning journey covered!

👉Subscribe to our updates and stay IPO-ready — always.

to schedule a free introductory appointment

+91 81234 26999

FINSPIREYOU@OUTLOOK.COM

© 2026 All Rights Reserved Sukruthi Finspire You

Registration granted by SEBI (INA000020493) , Membership of Bombay Stock Exchange (BSE Enlistment number 2288), and certification from the National Institute of Securities Markets (NISM) in no way guarantee the performance of the Investment Advisor or provide any assurance of returns to Investors. Investments in the securities market are subject to market risks. Read all the related documents carefully.

ARJUN K A

pROPRIETOR sUKRUTHI