Why India’s New Tax Regime Is Winning Hearts Across Salary Ranges

India’s tax landscape has undergone a seismic shift with the revamped New Tax Regime (NTR) introduced in Budget 2025.

Nagarjun

7/30/20254 min read

With simplified slabs, higher rebates, and reduced compliance, the NTR is now the default regime—and for good reason. Whether you're earning ₹7 lakh or ₹50 lakh+, the new regime offers compelling advantages that make it the smarter choice for most salaried individuals.

Let’s break it down by salary range and explore why the new regime is emerging as the go-to option.

🧮 Quick Recap: What’s New in the New Tax Regime?

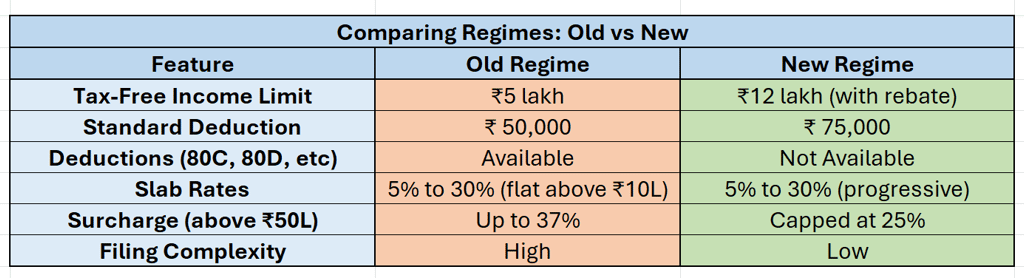

Zero tax on income up to ₹12 lakh (with rebate under Section 87A)

Standard deduction increased to ₹75,000

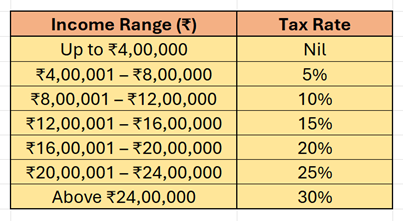

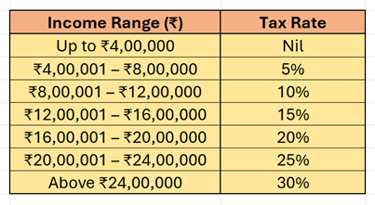

Simplified slabs with rates from 5% to 30%

No need for complex tax planning or documentation

Marginal relief up to ₹12.70 lakh ensures smooth transition

1️ Salary Range: ₹7 Lakh to ₹13 Lakh — The Zero-Tax Sweet Spot

For individuals in this bracket, the new regime is practically a tax holiday.

✅ Why It Works:

Zero tax liability: With the ₹75,000 standard deduction and ₹60,000 rebate, net taxable income up to ₹12.75 lakh attracts no tax.

No need for deductions: You don’t need to invest in ELSS, PPF, or buy insurance just to save tax.

Simplified filing: No paperwork, no proof submission—just file and relax.

📊 Example:

Let’s say your gross salary is ₹13 lakh. After standard deduction and employer NPS contribution (say ₹94,500), your taxable income drops below ₹12 lakh. Result? Zero tax.

💡 Verdict:

For this range, the new regime is a no-brainer. It offers maximum savings with minimum effort.

2️ Salary Range: ₹13 Lakh to ₹25 Lakh — The Efficiency Zone

This is where the new regime’s lower slab rates and streamlined structure shine.

✅ Why It Works:

Lower effective tax rates: Compared to the old regime’s flat 30% above ₹10 lakh, the new regime offers graduated rates—15% (₹12–16L), 20% (₹16–20L), and 25% (₹20–24L).

No need to chase deductions: If you’re not claiming ₹4–5 lakh in deductions, the new regime is more efficient.

Higher take-home pay: Less tax means more money in your pocket.

📊 Example:

At ₹18 lakh income, tax under the new regime is approx ₹1.2 lakh vs ₹1.9 lakh under the old regime—a savings of ₹70,000.

💡 Verdict:

Unless you’re maxing out deductions like HRA, 80C, 80D, and home loan interest, the new regime is more rewarding and less restrictive.

3️ Salary Range: ₹25 Lakh+ — The High-Income Advantage

For high earners, the new regime offers predictability and reduced surcharge.

✅ Why It Works:

Flat 30% rate above ₹24 lakh—same as old regime, but with lower surcharge (max 25% vs 37%).

No deduction limits: You don’t need to worry about caps on 80C or 80D.

Better for those with straightforward income: If you don’t have home loans or rent, the new regime is cleaner.

📊 Example:

At ₹50 lakh income, tax under the new regime is approx ₹10.8 lakh vs ₹11.9 lakh under the old regime—a savings of ₹1.1 lakh.

💡 Verdict:

For high-income earners who value simplicity and lower surcharge, the new regime is a strategic win.

🧠 Final Thoughts: Why the New Regime Is the Future

The new tax regime is designed for a modern workforce—young professionals, digital nomads, and salaried individuals who prefer flexibility over forced investments. It rewards simplicity, boosts take-home pay, and aligns with India’s push for transparent and efficient taxation.

Whether you're just starting out or scaling the corporate ladder, the new regime offers a cleaner, smarter, and more empowering way to manage your taxes.

✨ Pro Tip:

Before filing, use a tax calculator to compare both regimes. If your total deductions are less than ₹3.5–4 lakh, the new regime is likely your best bet.

📌 FAQs on India’s New Tax Regime (2025–26)

1. What is the New Tax Regime?

It’s a simplified tax structure with lower slab rates and minimal deductions, introduced under Section 115BAC. It’s now the default regime for individual taxpayers.

2. Is the New Tax Regime mandatory?

No. Taxpayers can opt out and choose the old regime while filing their ITR.

3. What are the updated tax slabs under the new regime?

4. What is the standard deduction under the new regime?

₹75,000 for salaried individuals and pensioners.

5. Is income up to ₹12 lakh tax-free?

Yes, due to the ₹60,000 rebate under Section 87A and standard deduction, income up to ₹12.75 lakh can result in zero tax liability.

6. Can I claim HRA under the new regime?

No. HRA exemption is not available under the new regime.

7. Are deductions under Section 80C allowed?

No. Investments like PPF, ELSS, LIC premiums are not deductible under the new regime.

8. Is health insurance premium deductible under Section 80D?

Not under the new regime. This benefit is exclusive to the old regime.

9. Can I claim home loan interest deduction?

Only for let-out properties. Interest on self-occupied homes is not deductible.

10. Is the new regime better for salaried individuals?

If your total deductions are less than ₹3.5–4 lakh, the new regime is likely more beneficial.

11. Can I switch between regimes every year?

Yes, if you don’t have business income. Business owners can switch only once.

12. What is Form 10-IEA?

It’s the form to opt out of the new regime if you have business/professional income.

13. Is the new regime beneficial for high-income earners?

Yes, due to lower surcharge rates (max 25% vs 37% in old regime) and simpler compliance.

14. Are NPS contributions deductible?

Yes, employer contributions up to 14% of basic salary are exempt under Section 80CCD(2).

15. Can I claim leave encashment exemption?

Yes. Up to ₹25 lakh is exempt under Section 10(10AA).

16. Is gratuity exempt under the new regime?

Yes. Gratuity up to ₹30 lakh is tax-free.

17. Are gifts taxable?

Gifts up to ₹50,000 are exempt. Beyond that, they may be taxable.

18. Is family pension deductible?

Yes. Up to ₹25,000 or 1/3rd of pension (whichever is lower) is deductible.

19. Is income from Agniveer Corpus Fund exempt?

Yes, both contributions and withdrawals are tax-free under Section 10(12C) and 80CCH.

20. What is marginal relief?

It ensures that tax payable doesn’t exceed the increase in income beyond ₹12 lakh. Relief applies up to ₹12.70 lakh.

to schedule a free introductory appointment

+91 81234 26999

FINSPIREYOU@OUTLOOK.COM

© 2026 All Rights Reserved Sukruthi Finspire You

Registration granted by SEBI (INA000020493) , Membership of Bombay Stock Exchange (BSE Enlistment number 2288), and certification from the National Institute of Securities Markets (NISM) in no way guarantee the performance of the Investment Advisor or provide any assurance of returns to Investors. Investments in the securities market are subject to market risks. Read all the related documents carefully.

ARJUN K A

pROPRIETOR sUKRUTHI